Secrets of Raising Money-Smart Children

Considering today’s borrowing and savings decisions, many consumers left home unprepared to manage their money - and plenty of stats support what you see. Experts recognize the problem and publish reams of financial knowledge to correct the behaviors, but why can’t we succeed? It’s not a simple fix.

Parents! Give Kids An Advantage

Since financial education has been my business focus for two decades, I’ve had chances to compare thoughts with hundreds of parents, teachers and home school groups about money-smart kids. Four common traits have surfaced. Those four insights are the foundation for my step-by-step, age-friendly "Save Yourself" Financial Education Platform.

If you're on this website, you are likely a concerned parent, grandparent, teacher or mentor. If you are looking for practical help to start teaching positive money skills and behaviors, I urge you read more here and

- Use the free downloads

- Check out my blog and subscribe

- Try my educational books and games.

- Have an interested group? I’m happy to speak too.

Check out the Money Godmother Blog here.

The Wants & Needs Game - great for your kids

How does a parent say "No" to a request for money when the child doesn't understand the basic difference between a want and a need? I developed this card game to start the dialogue between parents and kids on this important topic. My publisher test-marketed this game with tremendous positive feedback (and sales) so we reprinted.

Parents, teachers and home-schooling parents all told us the Wants and Needs Game encouraged some great learning moments and started many discussions about money. Contact us for bulk pricing.

Parents, teachers and home-schooling parents all told us the Wants and Needs Game encouraged some great learning moments and started many discussions about money. Contact us for bulk pricing.

$11.95 plus shipping

Go to the products page to learn more.

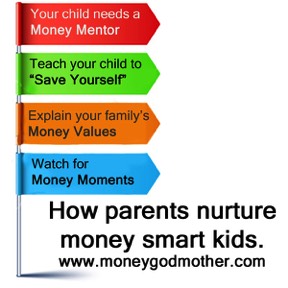

The Four Essential Steps to Financial Education At Home

We recommend a four-step approach, based on what has worked for other parents.

None of the four roles are difficult, but it does require a commitment of time and materials. Go to the Save Yourself button to learn more.

Parents Play the Key Role in Financial Education

The "missing link" in financial education is a parent or another adult (we call them Money Mentors) who can provide the encouragement and discipline to attain important learning and behavior goals. Examples? Encouraging kids to save money, learn the differences between wants and needs, having the courage to repel peer pressure, among others. Many of these topics can be folded into day-to-day activities, once you know how to recognize those opportunities. (we call those Money Moments.)

If you're interested in learning more, I encourage you to subscribe to my blog. Recent posts can be seen below.

If you're interested in learning more, I encourage you to subscribe to my blog. Recent posts can be seen below.

But for financial education to work, the knowledge, skills and behaviors all need to be taught and affirmed - often.

Ironically, we parents will invest time and money into athletics, music and other activities to provide our children with skills and developmental advantages. Yet, we often ignore the more important life skill - preparing them to become money-smart adults.

A parent or someone such as a grandparent or interested uncle must mentor the child, providing information, encouragement and, when needed, discipline.

WHO WE ARE

Joanne Seymour Kuster, an expert in financial education, focuses on strategies for families.

CONTACT US

Telephone: 515-991-3990

Email: Joanne@Dynamindspublishing.com

Email: Joanne@Dynamindspublishing.com

WHAT WE DO

Joanne consults with schools, home school groups and businesses the topics of financial education. She is also an author of several educational books, speaks frequently, and develops content for magazines and blogs. Her publishing company is DynaMinds Publishing.